Our Enterprise Risk Management (ERM) Policy provides the framework for managing risks across our Company, while striving to create more value for our stakeholders.

The risk management framework is integrated within the strategic planning process, which will engage all of the subsidiaries to be able to align with the overarching objectives of the Company. The principal goal of the organization is to maximize the value of the firm by achieving superior risk-adjusted returns for its stakeholders over the long-term.

Regular board meetings are conducted at DMCI HI together with the Presidents of each subsidiary to discuss the overall goals and objectives of the Group. DMCI HI Chief Executive Officer (CEO) also meets regularly with the Executive and Management Committees of the operating subsidiaries to discuss strategies, key result areas and critical enterprise-level risks to ensure a decisive response to their respective opportunities and challenges.

Our subsidiaries, through their respective functional units and business segments, employ a pragmatic approach to risk management, seeking to deliver our trademark operating efficiency while ensuring adherence to regulatory, contractual, health, safety and quality standards, and managing risks from planning to day-to-day operations.

The Chief Risk Officer (CRO) is responsible for enabling the facilitation and escalation of the strategy and risk management framework to the ROC which oversees the strategy and risk management of the Company and its subsidiaries The CRO is also tasked to lead efforts that oversee the entire risk management framework. The CRO is responsible for implementing policies and procedures to manage risks and ensure risk management strategies are executed. The CRO also leads the assessment and monitoring of risks across the entire organization by engaging with the different subsidiaries through the BURMs, as well as corporate functions that include finance, strategy, investor relations, human resources, and legal.

The risk management framework is integrated within the strategic planning process, which will engage all of the subsidiaries to be able to align with the overarching objectives of the Company. The principal goal of the organization is to maximize the value of the firm by achieving superior risk-adjusted returns for its stakeholders over the long-term. The Committee overseas and works with our CRO, General Counsel, Chief Compliance Officer and other senior management in ensuring that risk management responsibilities are effectively carried out.

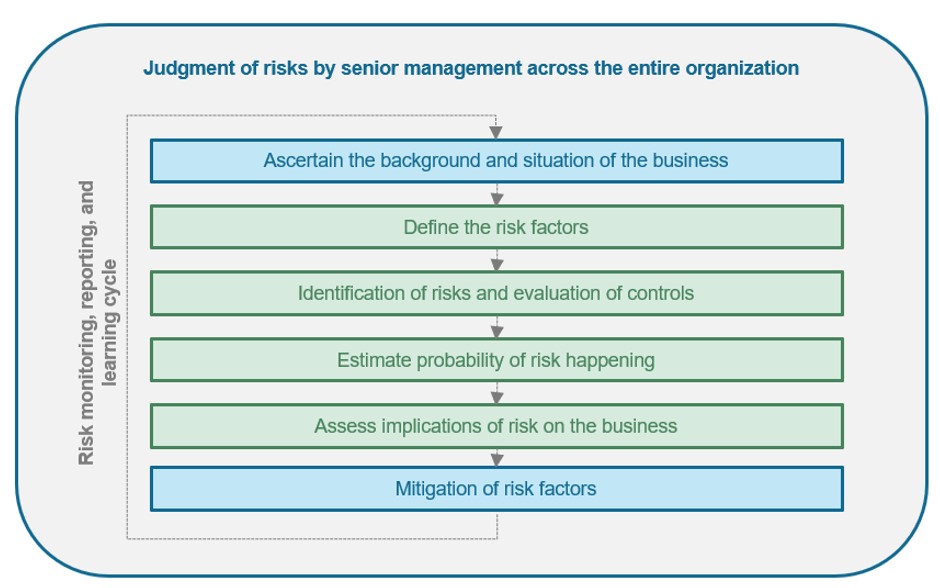

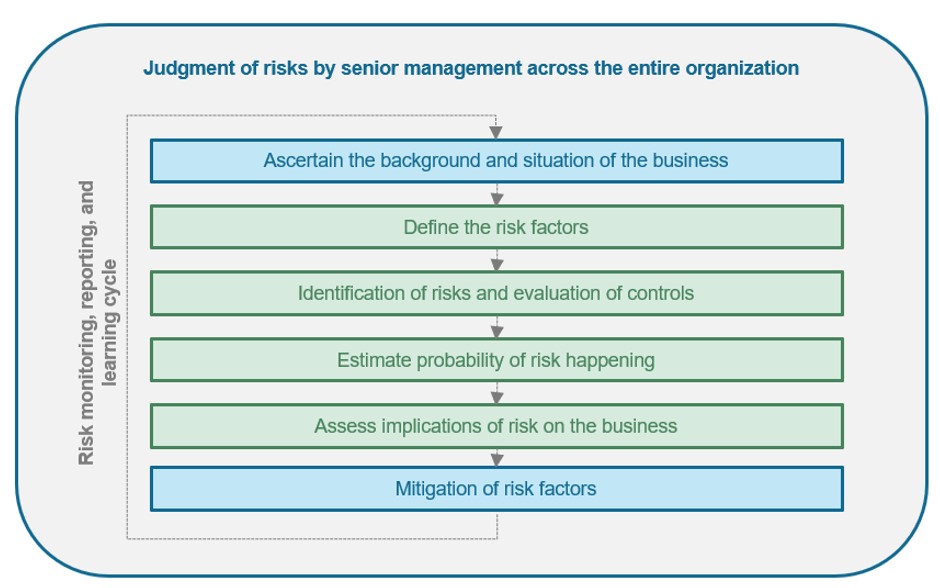

The risk management process is an essential part of business operations and entrenched in the organization’s culture and practices. The Company’s risk management framework consists of the following:

In 2022, the Risk Management Focal points were identified. The foregoing points, as shown in the matrix below, will be regularly tested through a Risk Management Assessment, along with the Strategic Planning Process.

- Macroeconomic risk: Slowdown in business activity due to global financial and local political, socio-economic turmoil, and security concerns may hamper business units from operating at optimal capacity. The acceleration of inflation will cause profit margins to narrow, while the volatility of commodity prices including coal and nickel will add uncertainty on the sales volume and revenue. Business units optimize production and operations depending on macroeconomic environment.

- Regulatory risk: DMCI HI is a conglomerate where some business activities are in regulated industries that regularly undergo a significant amount of regulatory and/or political changes. Any failure to predict or influence policy outcomes such as the denial of concessions and mining operations permits may have a material adverse effect on the group’s business and financial condition. Any constraints and limitations regarding ESG may hinder business units from operating at a cost-effective manner and may even restrict operations altogether. The group is actively monitoring the operating landscape for current regulations and any changes that may have an impact on existing and potential markets. Management nurtures relationships with all levels of government by conducting policy dialogues and consultations.

- Succession planning uncertainty: DMCI group of companies relies on certain key individuals in senior management for leadership, who have been integral in the group’s revenue and profitability. The experience, knowledge, business relationships and expertise that would be lost should these individuals retire could be difficult to replace and could result in a decrease in financial performance. DMCI HI periodically identifies potential successors to key management position and prepares talent for taking on greater responsibilities as the circumstances may require.

- Absence of investments for growth: DMCI HI invests in sectors that are believed to be key growth areas in the Philippines, particularly in infrastructure, mining, power generation, logistics, and real estate sectors. The group wants to establish its presence in allied businesses from which it can derive new sources of growth and value creation while managing the risks. Thorough discussion of the business plan, strategy for execution, and capital allocation are carried out by responsible business development personnel that are identified and are made accountable for a particular sector.

- Uncollected receivables and outstanding inventory: Receivables and inventories of businesses may be overdue which affect the cash flows and liquidity of the company. The business unit’s performance is measured against several metrics including days sales outstanding and days sales inventory, with the intention of establishing adequate financial controls over operating deliverables, ensuring proper credit lines are available, and monitoring the demand and supply imbalance.

- Power generation plants unavailability: Power plants may experience unplanned shutdown and forced outages of its power plants, thereby increasing the repairs and maintenance expenses as well as incur opportunity cost on potential energy sales. This can be mitigated through optimization of fuel blending and intensifying preventive maintenance activities.

- Credit health deterioration: Some of the business units under DMCI HI requires fund raising from external sources. Any inability to obtain financing from banks would adversely affect the company’s ability to execute its expansion plans. Business units set a maximum amount of debt maturities guided by a cash allocation plan to anticipate funding requirements, manage refinancing, and liquidity risks. The group’s portfolio of assets and strong balance sheet provides flexibility to tap both debt and equity capital markets in various stages of the economic cycle.

- Cybercrime: DMCI HI businesses are exposed to information and technology infrastructure downtime and potential breach to critical information due to malwares, hacking, and cybercrime. The group has a roadmap to strengthen and enhance existing security detection, vulnerability and patch management configuration management, identity access management, events monitoring, data loss prevention and network perimeter capabilities to ensure cyber threats are managed.

To mitigate such risks, we want to ensure that we are addressing the specific risk factors through a robust risk management system that will allow the company to maximize opportunities for reinvention and navigate challenges.